Budget 101 - A Quick Guide to Irvine's 2019-2021 Proposed Budget

A Special Message about School Support

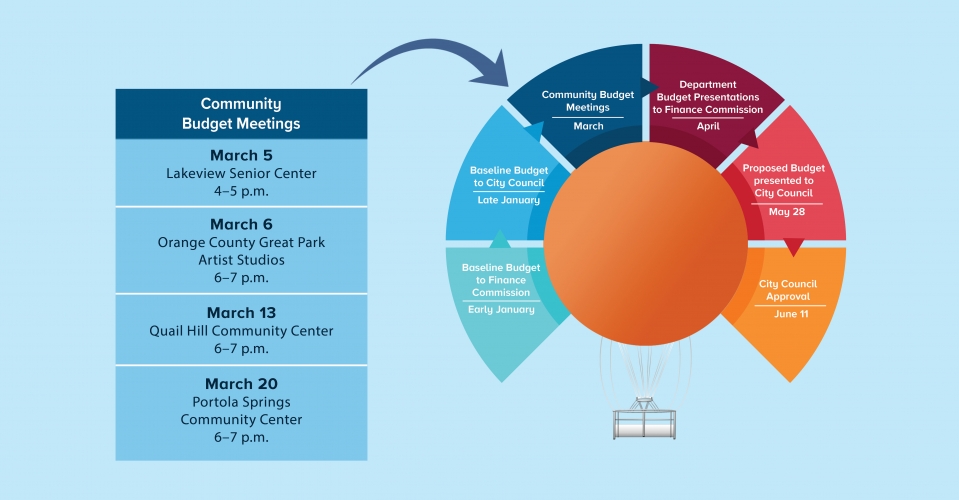

City staff is hosting a series of Community Budget Meetings during March 2019 to receive input from the community about the two-year budget. Questions and answers are posted here.

Q: Please elaborate on the recommendation to charge nonprofits?

A: Currently many nonprofit groups do not pay fees to use City facilities, such as city athletic and aquatic facilities. We are proposing to start charging nonprofit groups a minimal fee of $10-$20 per hour for reserving facilities for their specific uses. Even with these recommended fee increases, recreation programs and facilities will continue to be subsidized on average at 70%, and our fees will remain much lower than other Orange County cities.

Q: With the paydown program for the City’s unfunded pension liability, given the financial troubles at CalPERS, will our extra funding get soaked up by other cities in need?

A: Our funds are legally protected in separate, City-specific accounts.

Q: Will the overpayment to the Orange County Fire Authority (OCFA) be rectified?

A: City’s payments for fire services, to the OCFA, are not directly from the General Fund. Consequently, rectifying the overpayment will not be a balancing measure. There is a gap between how much the City’s taxpayers contribute to fire services and how much they actually receive in services through OCFA. City leadership has had extensive discussions with OCFA, and we are close to finalizing an agreement to rectify the overpayment.

Q: The largest portion of City revenue comes from property and sales taxes. Is this according to the State law?

A: Yes, the funding distribution of the property and sales taxes is pursuant to State law. Of the 1% base property tax, the City receives 2.7% (or 3 cents of every $1). The remainder goes to school districts, the county, and special districts. Of the 7.75% sales tax rate paid in Irvine, only 1% is allocated to Irvine, with the remainder going to the state, Public Safety services, Transportation agencies, and the County.

Q: We are an aging City with changing demographics, and aren’t there future expenses in infrastructure rehab?

A: The City’s population is indeed aging, and our Community Services Department has taken a deep look at how to better serve our seniors. And we are planning for infrastructure improvements, which are expensive, for all of the City’s critical infrastructure, including buildings and facilities, roads and sidewalks, vehicles and technology.

Q: Shouldn’t the City take out bonds to pay for any budget shortfall?

A: No. The use of bonds to pay for operating shortfall is not responsible; this balancing technique got San Bernardino and Detroit in financial trouble. Sustainable, ongoing balancing measures – cuts and revenue increases – are necessary to address the City’s operating budget deficit. We occasionally use debt for one-time capital needs, such as new road construction or new community facilities.

Q: How can I find budget information on the Orange County Great Park?

A: On March 18, the Great Park budget will be presented to the Finance Commission, and in April to the Great Park Board and City Council. A copy of that report is available on the City’s transparency portal, cityofirvine.org/transparency.

Q: How can we get further details on the Irvine Community Land Trust spending?

A: The Irvine Community Land Trust, similar to other key City partners, is scheduled to present to the City Council on May 14, 2019. That presentation will be posted on the City’s transparency portal, cityofirvine.org/transparency.

Q: How can people who could not attend these meetings provide feedback on the budget?

A: There are many ways to receive information on the City’s budget, and/or provide feedback:

- Visit the City’s Transparency Portal for budget information and responses to questions from the community meetings: cityofirvine.org/transparency.

- E-mail the City’s budget office at budget@cityofirvine.org

- E-mail the City Manager at cm@cityofirvine.org

- Contact the Mayor or City Council members; their e-mail addresses are listed on their respective webpages: cityofirvine.org/citycouncil

- Attend Finance Commission meetings in April or May; visit this webpage for schedule and agendas: legacy.cityofirvine.org/council/comms/finance/default.asp

- Attend City Council meetings in May or June; visit this webpage for schedule and agendas: cityofirvine.org/city-council/city-council-meetings

Q: Why are we losing tax revenue as our city is growing?

A: The City is not losing revenue. However, the revenue growth is slower than the increase in expenditures, particularly due to enhancing public safety and community services to accommodate the population growth.

Q: Please explain reducing staff in City Manager's Office, Community Development, and Community Services. What are we talking about?

A: Staff reductions are occurring or will soon be occurring in these departments as a result of vacancies or anticipated vacancies. Existing employees will be doing more work. For example, in the City Manager’s Office there is now one Assistant City Manager instead of two, the City Manager is also serving as the Great Park Director, and three out of eight support positions have been eliminated. Similarly, in Community Development and Community Services existing work is being reassigned to remaining staff after positions are eliminated due to retirements or otherwise employee departures.

Q: Please explain the Utility Users Tax.

A: The voters approved a 1.5 percent Utility Users Tax (UUT) on all business use of gas, electric, and telephone. The City provides exemptions to nonprofit and insurance companies. In addition, businesses can pay $5,000, 30 days prior the beginning of the fiscal year and be excluded from the UUT for 12-consecutive months. Once the business makes the $5,000 advance payment and comply with the timing requirement, the utility companies will be notified by the City to discontinue charging UUT for 12 months. UUT information is on the City's website, here.

Q: Please explain the Public Safety overtime reimbursement.

A: Public Safety overtime for calendar year 2018; among the $1.76M overtime total related to various special events, $1.58M, or 90 percent were reimbursed from grants of other revenue sources.